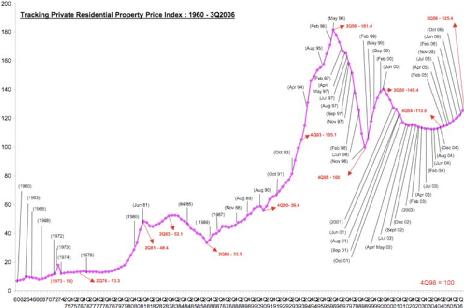

I did a bit of research and found the property index chart for the last 46 years (attached below). After punching in the values in my financial calculator, I found that the annual compounded growth rate in property is 6.73% over the last 43 years.

(Source: Redas.com)

Some people might think that 6.73% in too small a figure. Well, remember when you buy a property, you NEVER pay the full price of the house. You put a 20% down payment and borrow 80%. So what does this mean?

This means that if you had $100,000 to invest (to keep it simple)

=> You will be able to buy a property worth $500,000 (since you get 5 x leverage)

=> Assume you pay an interest rate of 3% for your mortgage

=> Your actual return will be 6.73%- 3% = 3.73%

=> So, your $ return will be ( 3.73%) x $500,000 = $18,650

=> Your return on investment will be $18,650/ $100,000 = 18.65% return!

So, with the power of gearing, investing in property over a long period of time will give you a 18.65% annual compounded rate of return (this is interest rate is 3%, for simplicity sake). However, this assumes you hold property through UPS and DOWNS

However, if you know how to study the property price chart and buy just as it is on an uptrend (LIKE NOW!!!) and get out when it begins to turn into a downtrend, then you could be making a lot higher returns. You can actually APPLY what Conrad and I taught at Wealth academy about TEHNICAL ANALYSIS on property charts. I guess I went in at the right time 3 years ago and just caught the new bull run. According to a statement made by Singapore billionaire Kwek Leng beng (Chairman of Hong leong Group), this bull run would be Singapore’s strongest and could last to 2012.

Have Fun and Make Money

Sources (Adam Khoo)

No comments:

Post a Comment