As under $1m property appeals more to most people, let’s take example of a 2rm property in District 11 (abt 12mins walk from Novena MRT) at $900k.

Assuming 80% loan at 3.5%…

Property Price: S$900k

Your Investment: $180k

Monthly Installment: $3233

Potential Rental Return for this property has been between $3800 – $4200 in the past 3 mths. But let’s use the lower rate.

At $3800, means a Rental Yield of 5.06%(3800×12/900k). That’s not bad for Singapore investment!

But then, your actual investment is really the initial capital of $180k, so adding misc cost like stamp-duty, maintenance, legal, etc, your total cost is perhaps $205k.

Therefore, using $205k of your cash to invest in property that generates $45.6k annually means a whopping 22.24% ROI !!! Now which investment in Singapore gives you such return over 2years at least. Not forgetting you still own a physically asset, which has no monthly installment to worry (as the $3800 rental pays the monthly installment of $3233 $180 maintenance fees).

Not forgetting, you can also potentially collect “bonus” in capital appreciation, during a bull-run. Assuming annual growth of 6%, that could mean potentially capital appreciation of at least another $100k to $200k. That should more than take care of all cost, including interest incurred over 2years.

of course, like any investment with high returns, there’s always downside risk. But unlike stock (which can drop to 0), you still have a physical asset that you can still rent out if the market is not favourable for sale, and generate income to pay towards part if not all of your monthly installment while you wait for the next wave.

So the bottom line is, may sure you have holding power before you enter any investment. Not only should you have the cash to invest, but also the cash to hold to weather thru any storm.

Sigh… now we know why why the rich people gets richer.

Friday, October 23, 2009

Property Investment in Singapore by Foreigners

Introduction

Since 1973, the Singapore Government has imposed restrictions on foreign ownership of private residential property in Singapore.

In its drive to attract foreign talent to Singapore, the government however makes concessions for permanent residents, foreign companies and limited liability partnerships that make an economic contribution to Singapore to purchase such properties for their occupation. In fact, over the years, the government has relaxed some of the restrictions for e.g. since 19 July 2005, foreigners can purchase apartments in non-condominium developments of less than 6 levels without the need to obtain prior approval. Other such schemes include the Global Investor Programme (see topic below).

Foreigners and Restricted Property

A) Foreigners:

The Residential Property Act is the governing legislation for private residential property whilst the Housing and Development Board ("HDB") is the relevant authority for purchase of any HDB property.

As long as you are NOT a:

1. Singapore citizen;

2. Singapore company;

3. Singapore limited liability partnership; or

4. Singapore society.

B) Restricted Property

You will need to acquire approval from the relevant authorities to purchase:

1. vacant residential land;

2. landed property [i.e detached house, semi-detached house, terrace house (including linked house or townhouse); and

3. landed property in strata developments which are not approved condominium developments under the Planning Act.

4. shophouse which is not strata subdivided and is erected on land which has been zoned "residential", (this is not an exhaustive definition. You should seek advice from your lawyers who will be able to advise you based on the reply of the Chief Executive Officer, URA, on the zoning and approved use of the property)

5. all the apartments within a building or all the units in an approved condominium development without the prior approval of the Minister for Law or

6. a leasehold estate in restricted residential property for a term not exceeding 7 years, including any further term which may be granted by way of an option for renewal.

7. an HDB flat purchased directly from HDB;

8. a resale HDB flat where HDB has consented to the sale;

9. an HDB shophouse; and

10. An Executive Condominium purchased under the Executive Condominium Housing Scheme Act, 1996.

You are however allowed to purchase without prior approval

1. any apartment within a building or

2. any unit in an approved condominium development under the Planning Act.

Property Investments for Permanent Resident Application

Under the Global Investor Programme (GIP) administered by the Economic Development Board (EDB), foreigners can be considered for Permanent Resident (PR) status if they invest a certain minimum sum in business set-ups and/or other investment vehicles such as venture capital funds, foundations or trusts that focus on economic development.

Private residential properties investment can be considered for application for Permanent Resident application if the foreigner invests at least S$2 million in business set-ups, other investment vehicles such as venture capital funds, foundations or trusts, and/or private residential properties. Up to 50% of the investment can be in private residential properties, subject to foreign ownership restrictions under the Residential Property Act (RPA). This is to attract and anchor foreign talent in Singapore.

Eligibility

A) Residential Property Act

For restricted property listed under items 1-4 of "Restricted Property", approval is granted only to a foreign individual if the foreigner intends to use it for his own stay.

An "Approval-In-Principle (AIP)" application can be made even when the specific property is not found yet. The AIP, if granted, is valid for 6 months. It is not renewable. Once the 6-month period has lapsed, a fresh application must be made for another Approval In-Principle or for purchase of a specific property.

Every application is considered on its own merits. The main criteria are whether the foreign individual is a permanent resident of Singapore and his/her economic contribution to Singapore.

In assessing the economic contribution to Singapore, the main factors considered are :

1. professional/technical/academic qualifications;

2. expertise and working experience needed by Singapore; and

3. investments in the type of industry or service sector needed in Singapore.

Processing time is about 5 weeks. If the application is not approved, any appeal must be made within three months from the date of the letter of disapproval.

Conditions:

The following conditions are usually imposed if your application is approved:

1. You cannot sell your estate and interest in the property within 3 years after the date of purchase of the property or 3 years after the date of issue of the Temporary Occupation Permit or 3 years after the date of issue of the Certificate of Statutory Completion, whichever is earlier.

2. The land area of the property should not exceed 1393.5 sq metres/15,000 sq ft.

3. The property will be used solely by you for your own occupation and that of your family members as a dwelling house and not for rental or any other purpose. You are required to give an undertaking to this effect. Breach of this undertaking is an offence under Section 25(8) of the Residential Property Act for which an offender may be liable on conviction to a fine not exceeding $5,000 or to imprisonment for a term not exceeding 3 years or both.

4. Where an application is for vacant residential land, approval will be subject to the additional conditions of:

a. obtaining the Notice of Grant of Written Permission for the construction of the dwelling house within 6 months after the date of the letter conveying the Minister's decision;

b. obtaining the Temporary Occupation Permit or Certificate of Statutory Completion (whichever is earlier) within 24 months after the date of issue of the Notice of Grant of Written Permission;

c. furnishing a Banker's Guarantee of $50,000 or 1% of the purchase price of the property (whichever is higher) as security for the compliance of the conditions imposed.

5. Where an application is also to tear down the existing dwelling house on the property to build a new dwelling house or to carry out reconstruction of the existing dwelling house; or to carry out addition and alteration works to the existing dwelling house, additional approval from the Government is required. 6. If the foreigner already own a restricted residential property (not HDB or Executive Condominium) at the time of application, the existing property must be disposed off

a. (where separate legal title has been issued for the new property to be purchased), on or before the legal completion of the purchase of the new property; or

b. (where the new property to be purchased is under construction), within 3 months from the date issue of the Temporary Occupation Permit or Certificate of Statutory Completion (whichever is the earlier) for the new property; or

c. (where the Temporary Occupation Permit or Certificate of Statutory Completion for the new property to be purchased has been issued but separate legal title has not been issued), within 3 months from the date when the seller delivers vacant possession of the new property to you.

7. If the foreigner and/or his/her spouse own an HDB flat or a non-privatised HUDC Phase III or IV flat, he/she is strongly advised to check with HDB as to whether they are eligible to retain their HDB flat without owner-occupation under the HDB's existing policies, before he/she proceed to purchase a restricted residential property. If the foreigner or spouse is not eligible to retain the HDB flat without owner-occupation, he/she will be required by HDB to dispose of the flat within such time as may be specified by HDB.

8. If the foreigner and/or spouse own an Executive Condominium (EC) purchased under the Executive Condominium Housing Scheme Act 1996, they are not allowed to dispose of the EC within the Minimum Occupation Period of 5 years starting from the date of issue of its Temporary Occupation Permit nor acquire an interest in another residential property or HDB flat within this period.

Bequests

Under the Residential Property Act, a foreign person cannot acquire/inherit a restricted residential property unless he obtains approval. If approval is not granted to him, the personal representatives of the estate of the deceased person must dispose of the foreign person's share in the restricted residential property within 10 years from the date of death of the deceased person.

The foreigner may will his/her property to a foreign person as beneficiary. However, upon death, the foreign beneficiary will likewise have to obtain Minister's approval to acquire the estate or the personal representative will have to sell the foreign beneficiary's share within 10 years of the date of death of the deceased person.

The personal representative can apply for an extension of time to dispose of the property if required.

B) HDB

For HDB flats, HDB shophouse and executive condominiums, eligibility is subjected to the Housing And Development Board.

Generally, foreigners are not allowed to buy a flat directly from HDB. To buy a flat from the resale market, you must be a Singapore citizen or Singapore permanent resident. You must also include at least one listed occupier who is a Singapore permanent resident or Singapore citizen.

As mentioned earlier, if you or your spouse owns a HDB flat, an EC or a non-privatised HUDC Phase III or IV flat, it is critical that you seek HDB's approval before you intend to buy another residential property. Infringement of HDB regulations may cause your HDB flat to be forfeited.

Documentation for Your Intended Purchase

There is generally two ways you can transact when you intend to buy a private residential property, by way of an Option To Purchase or by entering into a Sale and Purchase Agreement. Both are contracts between the relevant parties with terms that should be negotiated before any commitment by either party.

Transacting by option is more common. You usually pay 1% of the purchase price ("option money") in exchange for the Option to Purchase. You are usually given 14 days to decide whether to proceed with the purchase. If you decide to proceed, exercise the option by signing and forward it to the seller's solicitor together with another 4% of the purchase price. If you do not intend to proceed, the Vendor will be entitled to forfeit your option money. Completion will usually be 8-12 weeks thereafter.

If you transact by way of a Sale and Purchase Agreement, you pay a deposit (usually 5-10% of the purchase price) and you must proceed with the purchase unless the vendor is unable to fulfill certain conditions under the Agreement.

It is crucial, before you buy an Option or enter into any agreement that you consult with your lawyers on the terms of the Option. (See below for some of the Purchase Terms) as frequently, these terms may be prejudicial to your rights or may not take into consideration your special circumstances.

If you need to make a commitment before you can consult with a lawyer, ask the realtor to prepare an Offer to Purchase clearly stating the price, property description and particulars of the parties (vendors and purchasers) as well as the fact that the payment of your option money is subject to terms and conditions. All payment must be made "Subject To Contract". Write these words clearly on the back of the cheque for the option money and the Offer To Purchase.

Purchase Terms

Please note that this is not an exhaustive list of purchase terms you should watch out for. ALL terms are important and will have a significant bearing on your rights. This article will however highlight some of the terms you must incorporate if you are a foreigner buying a restricted private property.

1) Parties/Price/Property

Make sure that the description of all the above is accurate. You will not be allowed to add or remove any purchasers after you have exercised the option without paying additional stamp duty.

2) Approval

It is critical that your purchase must subject to your obtaining Government approval failing which the Option to Purchase or Sale and Purchase Agreement is null and void.

3) Time Period

There are 2 important datelines which you will have to note. The date for exercising option and the date for completion where you pay up the balance of the purchase price and the title the property is transferred to you.

Make sure that the datelines accommodate the time required for your application for approval.

I must emphasize here again that you should try to seek your lawyer's advice before you part with any money. It is not true that you can only use an Option To Purchase prepared by the vendor. Nor is it true that a realtor's option is always fair. Each transaction is unique and at the very least, your lawyer will ensure, before you part with your money, that the purported vendors are indeed the owners of the property by conducting a title search of the property.

In Singapore, property investment often entails large sum of money, even if it is only 1% of the purchase price. It is prudent therefore that a lawyer runs through with you the terms of your purchase and if necessary, negotiate the terms for you before you make such a heavy commitment.

Be sure to inform your lawyer of your special requirements e.g. if you are a foreigner etc so that he/she can ensure that the critical terms are incorporated into your contract.

Conclusion:

In the recent months, there has been an increased in foreign buyers of Singapore's property and their purchases are fuelling the market. They now make up almost 25% of the buyers, compared to 15% five years ago.

This is largely due to an optimistic outlook that Singapore's property is rebounding on stronger fundamentals, looking forward to even better days after 2010 when the two planned casino resorts begin operation.

The projection is also that the city's 4.5 million population is likely to increase to some 7 million by 2030 with a large intake of foreigners. In land scarce Singapore, this means that demand for homes can only continue to rise.

Since 1973, the Singapore Government has imposed restrictions on foreign ownership of private residential property in Singapore.

In its drive to attract foreign talent to Singapore, the government however makes concessions for permanent residents, foreign companies and limited liability partnerships that make an economic contribution to Singapore to purchase such properties for their occupation. In fact, over the years, the government has relaxed some of the restrictions for e.g. since 19 July 2005, foreigners can purchase apartments in non-condominium developments of less than 6 levels without the need to obtain prior approval. Other such schemes include the Global Investor Programme (see topic below).

Foreigners and Restricted Property

A) Foreigners:

The Residential Property Act is the governing legislation for private residential property whilst the Housing and Development Board ("HDB") is the relevant authority for purchase of any HDB property.

As long as you are NOT a:

1. Singapore citizen;

2. Singapore company;

3. Singapore limited liability partnership; or

4. Singapore society.

B) Restricted Property

You will need to acquire approval from the relevant authorities to purchase:

1. vacant residential land;

2. landed property [i.e detached house, semi-detached house, terrace house (including linked house or townhouse); and

3. landed property in strata developments which are not approved condominium developments under the Planning Act.

4. shophouse which is not strata subdivided and is erected on land which has been zoned "residential", (this is not an exhaustive definition. You should seek advice from your lawyers who will be able to advise you based on the reply of the Chief Executive Officer, URA, on the zoning and approved use of the property)

5. all the apartments within a building or all the units in an approved condominium development without the prior approval of the Minister for Law or

6. a leasehold estate in restricted residential property for a term not exceeding 7 years, including any further term which may be granted by way of an option for renewal.

7. an HDB flat purchased directly from HDB;

8. a resale HDB flat where HDB has consented to the sale;

9. an HDB shophouse; and

10. An Executive Condominium purchased under the Executive Condominium Housing Scheme Act, 1996.

You are however allowed to purchase without prior approval

1. any apartment within a building or

2. any unit in an approved condominium development under the Planning Act.

Property Investments for Permanent Resident Application

Under the Global Investor Programme (GIP) administered by the Economic Development Board (EDB), foreigners can be considered for Permanent Resident (PR) status if they invest a certain minimum sum in business set-ups and/or other investment vehicles such as venture capital funds, foundations or trusts that focus on economic development.

Private residential properties investment can be considered for application for Permanent Resident application if the foreigner invests at least S$2 million in business set-ups, other investment vehicles such as venture capital funds, foundations or trusts, and/or private residential properties. Up to 50% of the investment can be in private residential properties, subject to foreign ownership restrictions under the Residential Property Act (RPA). This is to attract and anchor foreign talent in Singapore.

Eligibility

A) Residential Property Act

For restricted property listed under items 1-4 of "Restricted Property", approval is granted only to a foreign individual if the foreigner intends to use it for his own stay.

An "Approval-In-Principle (AIP)" application can be made even when the specific property is not found yet. The AIP, if granted, is valid for 6 months. It is not renewable. Once the 6-month period has lapsed, a fresh application must be made for another Approval In-Principle or for purchase of a specific property.

Every application is considered on its own merits. The main criteria are whether the foreign individual is a permanent resident of Singapore and his/her economic contribution to Singapore.

In assessing the economic contribution to Singapore, the main factors considered are :

1. professional/technical/academic qualifications;

2. expertise and working experience needed by Singapore; and

3. investments in the type of industry or service sector needed in Singapore.

Processing time is about 5 weeks. If the application is not approved, any appeal must be made within three months from the date of the letter of disapproval.

Conditions:

The following conditions are usually imposed if your application is approved:

1. You cannot sell your estate and interest in the property within 3 years after the date of purchase of the property or 3 years after the date of issue of the Temporary Occupation Permit or 3 years after the date of issue of the Certificate of Statutory Completion, whichever is earlier.

2. The land area of the property should not exceed 1393.5 sq metres/15,000 sq ft.

3. The property will be used solely by you for your own occupation and that of your family members as a dwelling house and not for rental or any other purpose. You are required to give an undertaking to this effect. Breach of this undertaking is an offence under Section 25(8) of the Residential Property Act for which an offender may be liable on conviction to a fine not exceeding $5,000 or to imprisonment for a term not exceeding 3 years or both.

4. Where an application is for vacant residential land, approval will be subject to the additional conditions of:

a. obtaining the Notice of Grant of Written Permission for the construction of the dwelling house within 6 months after the date of the letter conveying the Minister's decision;

b. obtaining the Temporary Occupation Permit or Certificate of Statutory Completion (whichever is earlier) within 24 months after the date of issue of the Notice of Grant of Written Permission;

c. furnishing a Banker's Guarantee of $50,000 or 1% of the purchase price of the property (whichever is higher) as security for the compliance of the conditions imposed.

5. Where an application is also to tear down the existing dwelling house on the property to build a new dwelling house or to carry out reconstruction of the existing dwelling house; or to carry out addition and alteration works to the existing dwelling house, additional approval from the Government is required. 6. If the foreigner already own a restricted residential property (not HDB or Executive Condominium) at the time of application, the existing property must be disposed off

a. (where separate legal title has been issued for the new property to be purchased), on or before the legal completion of the purchase of the new property; or

b. (where the new property to be purchased is under construction), within 3 months from the date issue of the Temporary Occupation Permit or Certificate of Statutory Completion (whichever is the earlier) for the new property; or

c. (where the Temporary Occupation Permit or Certificate of Statutory Completion for the new property to be purchased has been issued but separate legal title has not been issued), within 3 months from the date when the seller delivers vacant possession of the new property to you.

7. If the foreigner and/or his/her spouse own an HDB flat or a non-privatised HUDC Phase III or IV flat, he/she is strongly advised to check with HDB as to whether they are eligible to retain their HDB flat without owner-occupation under the HDB's existing policies, before he/she proceed to purchase a restricted residential property. If the foreigner or spouse is not eligible to retain the HDB flat without owner-occupation, he/she will be required by HDB to dispose of the flat within such time as may be specified by HDB.

8. If the foreigner and/or spouse own an Executive Condominium (EC) purchased under the Executive Condominium Housing Scheme Act 1996, they are not allowed to dispose of the EC within the Minimum Occupation Period of 5 years starting from the date of issue of its Temporary Occupation Permit nor acquire an interest in another residential property or HDB flat within this period.

Bequests

Under the Residential Property Act, a foreign person cannot acquire/inherit a restricted residential property unless he obtains approval. If approval is not granted to him, the personal representatives of the estate of the deceased person must dispose of the foreign person's share in the restricted residential property within 10 years from the date of death of the deceased person.

The foreigner may will his/her property to a foreign person as beneficiary. However, upon death, the foreign beneficiary will likewise have to obtain Minister's approval to acquire the estate or the personal representative will have to sell the foreign beneficiary's share within 10 years of the date of death of the deceased person.

The personal representative can apply for an extension of time to dispose of the property if required.

B) HDB

For HDB flats, HDB shophouse and executive condominiums, eligibility is subjected to the Housing And Development Board.

Generally, foreigners are not allowed to buy a flat directly from HDB. To buy a flat from the resale market, you must be a Singapore citizen or Singapore permanent resident. You must also include at least one listed occupier who is a Singapore permanent resident or Singapore citizen.

As mentioned earlier, if you or your spouse owns a HDB flat, an EC or a non-privatised HUDC Phase III or IV flat, it is critical that you seek HDB's approval before you intend to buy another residential property. Infringement of HDB regulations may cause your HDB flat to be forfeited.

Documentation for Your Intended Purchase

There is generally two ways you can transact when you intend to buy a private residential property, by way of an Option To Purchase or by entering into a Sale and Purchase Agreement. Both are contracts between the relevant parties with terms that should be negotiated before any commitment by either party.

Transacting by option is more common. You usually pay 1% of the purchase price ("option money") in exchange for the Option to Purchase. You are usually given 14 days to decide whether to proceed with the purchase. If you decide to proceed, exercise the option by signing and forward it to the seller's solicitor together with another 4% of the purchase price. If you do not intend to proceed, the Vendor will be entitled to forfeit your option money. Completion will usually be 8-12 weeks thereafter.

If you transact by way of a Sale and Purchase Agreement, you pay a deposit (usually 5-10% of the purchase price) and you must proceed with the purchase unless the vendor is unable to fulfill certain conditions under the Agreement.

It is crucial, before you buy an Option or enter into any agreement that you consult with your lawyers on the terms of the Option. (See below for some of the Purchase Terms) as frequently, these terms may be prejudicial to your rights or may not take into consideration your special circumstances.

If you need to make a commitment before you can consult with a lawyer, ask the realtor to prepare an Offer to Purchase clearly stating the price, property description and particulars of the parties (vendors and purchasers) as well as the fact that the payment of your option money is subject to terms and conditions. All payment must be made "Subject To Contract". Write these words clearly on the back of the cheque for the option money and the Offer To Purchase.

Purchase Terms

Please note that this is not an exhaustive list of purchase terms you should watch out for. ALL terms are important and will have a significant bearing on your rights. This article will however highlight some of the terms you must incorporate if you are a foreigner buying a restricted private property.

1) Parties/Price/Property

Make sure that the description of all the above is accurate. You will not be allowed to add or remove any purchasers after you have exercised the option without paying additional stamp duty.

2) Approval

It is critical that your purchase must subject to your obtaining Government approval failing which the Option to Purchase or Sale and Purchase Agreement is null and void.

3) Time Period

There are 2 important datelines which you will have to note. The date for exercising option and the date for completion where you pay up the balance of the purchase price and the title the property is transferred to you.

Make sure that the datelines accommodate the time required for your application for approval.

I must emphasize here again that you should try to seek your lawyer's advice before you part with any money. It is not true that you can only use an Option To Purchase prepared by the vendor. Nor is it true that a realtor's option is always fair. Each transaction is unique and at the very least, your lawyer will ensure, before you part with your money, that the purported vendors are indeed the owners of the property by conducting a title search of the property.

In Singapore, property investment often entails large sum of money, even if it is only 1% of the purchase price. It is prudent therefore that a lawyer runs through with you the terms of your purchase and if necessary, negotiate the terms for you before you make such a heavy commitment.

Be sure to inform your lawyer of your special requirements e.g. if you are a foreigner etc so that he/she can ensure that the critical terms are incorporated into your contract.

Conclusion:

In the recent months, there has been an increased in foreign buyers of Singapore's property and their purchases are fuelling the market. They now make up almost 25% of the buyers, compared to 15% five years ago.

This is largely due to an optimistic outlook that Singapore's property is rebounding on stronger fundamentals, looking forward to even better days after 2010 when the two planned casino resorts begin operation.

The projection is also that the city's 4.5 million population is likely to increase to some 7 million by 2030 with a large intake of foreigners. In land scarce Singapore, this means that demand for homes can only continue to rise.

Labels:

Buy,

Foreigners,

Legal,

Property Investment,

Singapore Property

Is Singapore Property A Good Investment Right Now?

During the last Wealth Academy, a couple of people asked whether property was a good investment, especially in Singapore. Well, I am no property expert, but I did make quite a handsome profit on a property (semi-D) I bought 2 years ago. Bought it for $1.7m and not just got the latest valuation of $2.5m (50% increase in 2 years). So will property continue to boom in the next 5-10 years?

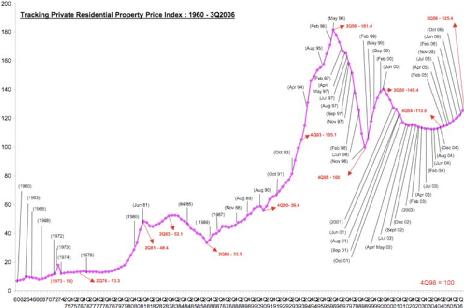

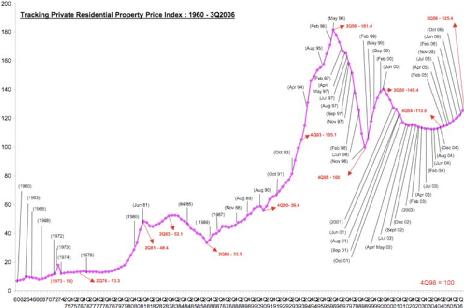

I did a bit of research and found the property index chart for the last 46 years (attached below). After punching in the values in my financial calculator, I found that the annual compounded growth rate in property is 6.73% over the last 43 years.

(Source: Redas.com)

Some people might think that 6.73% in too small a figure. Well, remember when you buy a property, you NEVER pay the full price of the house. You put a 20% down payment and borrow 80%. So what does this mean?

This means that if you had $100,000 to invest (to keep it simple)

=> You will be able to buy a property worth $500,000 (since you get 5 x leverage)

=> Assume you pay an interest rate of 3% for your mortgage

=> Your actual return will be 6.73%- 3% = 3.73%

=> So, your $ return will be ( 3.73%) x $500,000 = $18,650

=> Your return on investment will be $18,650/ $100,000 = 18.65% return!

So, with the power of gearing, investing in property over a long period of time will give you a 18.65% annual compounded rate of return (this is interest rate is 3%, for simplicity sake). However, this assumes you hold property through UPS and DOWNS

However, if you know how to study the property price chart and buy just as it is on an uptrend (LIKE NOW!!!) and get out when it begins to turn into a downtrend, then you could be making a lot higher returns. You can actually APPLY what Conrad and I taught at Wealth academy about TEHNICAL ANALYSIS on property charts. I guess I went in at the right time 3 years ago and just caught the new bull run. According to a statement made by Singapore billionaire Kwek Leng beng (Chairman of Hong leong Group), this bull run would be Singapore’s strongest and could last to 2012.

Have Fun and Make Money

Sources (Adam Khoo)

I did a bit of research and found the property index chart for the last 46 years (attached below). After punching in the values in my financial calculator, I found that the annual compounded growth rate in property is 6.73% over the last 43 years.

(Source: Redas.com)

Some people might think that 6.73% in too small a figure. Well, remember when you buy a property, you NEVER pay the full price of the house. You put a 20% down payment and borrow 80%. So what does this mean?

This means that if you had $100,000 to invest (to keep it simple)

=> You will be able to buy a property worth $500,000 (since you get 5 x leverage)

=> Assume you pay an interest rate of 3% for your mortgage

=> Your actual return will be 6.73%- 3% = 3.73%

=> So, your $ return will be ( 3.73%) x $500,000 = $18,650

=> Your return on investment will be $18,650/ $100,000 = 18.65% return!

So, with the power of gearing, investing in property over a long period of time will give you a 18.65% annual compounded rate of return (this is interest rate is 3%, for simplicity sake). However, this assumes you hold property through UPS and DOWNS

However, if you know how to study the property price chart and buy just as it is on an uptrend (LIKE NOW!!!) and get out when it begins to turn into a downtrend, then you could be making a lot higher returns. You can actually APPLY what Conrad and I taught at Wealth academy about TEHNICAL ANALYSIS on property charts. I guess I went in at the right time 3 years ago and just caught the new bull run. According to a statement made by Singapore billionaire Kwek Leng beng (Chairman of Hong leong Group), this bull run would be Singapore’s strongest and could last to 2012.

Have Fun and Make Money

Sources (Adam Khoo)

Labels:

Good Investment,

Right Time,

Singapore Property

Urban Suites at Hullet Road?

CapitaLand waiting for the right time

As posted in Business Times on June 20, 2009

BUYERS may be rushing back to the private housing market, but CapitaLand is in no rush to release new projects. ‘If we think there is potential in a piece of land when the market recovers, there is really no need for us to rush to launch it,’ CapitaLand Residential Singapore’s chief executive Patricia Chia told BT in an interview.

CapitaLand has sold more than 150 residential units in Singapore so far this year, versus less than 100 it sold last year. Most recent sales were at The Wharf Residence, one of several properties in the mid- and high-end sectors to benefit from a recent rise in optimism. Last month, buyers took up 1,668 apartments, setting a year-high.

While CapitaLand’s sales have picked up, they are still far behind those clocked up in 2006 and 2007 when it sold some 2,400 units. Robust take-up in those two years has relieved pressure to sell today, Ms Chia said.

CapitaLand has more than 2,700 units in the works – from the Silver Tower, Char Yong Gardens, Gillman Heights and Farrer Court sites it acquired some years back. It plans to start launching them after the third quarter of 2009 at the earliest.

The units represent some 4.5 million sq ft of space. CapitaLand’s effective stake is close to two million sq ft while its partners in some of the projects hold the rest.

According to Ms Chia, the Silver Tower site – renamed Urban Resort Condominium – and the Char Yong Gardens site will hit the market first, towards the end of the year when the new malls in Orchard Road are up and running.

‘That period will enable us to really maximise the value for these two developments,’ she said.

The Urban Resort Condominium will have 64 units and the Char Yong Gardens plot will yield around 150. The freehold parcels, next to each other, will feature complementary resort-style designs, courtesy of Kerry Hill Architects.

In a June 10 report, Kim Eng analyst Wilson Liew estimated the projects will sell for an average of $2,000 psf.

The 99-year leasehold Gillman Heights (The Interlace) plot is next in line for release, and some 1,000 units should be ready for launch at the start of 2010. CapitaLand and its consortium partners took more than two years to close the $548 million deal last month and will begin redevelopment after November, when all residents have left.

The group has appointed OMA – known for the CCTV headquarters project in Beijing – to design the project. There will be ‘a lot of attention to space’, to tie in with the site’s proximity to the southern ridges, said Ms Chia.

Kim Eng’s Mr Liew has estimated a breakeven cost of $753 psf for the site, with an average selling price of $900 psf.

Among the last to come on-stream will be the Farrer Court site near Farrer Road, which CapitaLand bought with partners for more than $1.33 billion in 2007. The project, near the popular Nanyang Primary School, will comprise seven 36-storey blocks with around 1,500 units, offering residents a good view of the area, Ms Chia said.

‘If we were to launch it today, we would not be doing justice to the site,’ she said. The launch will happen ‘when the market is ready to accept that location with the kind of pricing that we want’.

According to Urban Redevelopment Authority caveats, units at the 12-year-old Gallop Gables nearby sold for up to $1,312 psf last month. Reports last year suggested the breakeven cost for the Farrer Court project could range from $1,350 – $1,450 psf. But Ms Chia said that this should have fallen as construction and other costs have eased about 20 per cent since.

‘We have a very strong financial position,’ she said. ‘It gives us quite a lot of flexibility to plan our launches.’

According to her, CapitaLand Residential Singapore typically has a market share of 8-10 per cent on a three-year moving average basis.

Ms Chia remains fairly upbeat on the property market here. The general consensus points to Asia as the economic growth leader, and Singapore is one of the few cosmopolitan cities in the region where asset values have corrected to ‘reasonable’ levels, she said.

.

As posted in Business Times on June 20, 2009

BUYERS may be rushing back to the private housing market, but CapitaLand is in no rush to release new projects. ‘If we think there is potential in a piece of land when the market recovers, there is really no need for us to rush to launch it,’ CapitaLand Residential Singapore’s chief executive Patricia Chia told BT in an interview.

CapitaLand has sold more than 150 residential units in Singapore so far this year, versus less than 100 it sold last year. Most recent sales were at The Wharf Residence, one of several properties in the mid- and high-end sectors to benefit from a recent rise in optimism. Last month, buyers took up 1,668 apartments, setting a year-high.

While CapitaLand’s sales have picked up, they are still far behind those clocked up in 2006 and 2007 when it sold some 2,400 units. Robust take-up in those two years has relieved pressure to sell today, Ms Chia said.

CapitaLand has more than 2,700 units in the works – from the Silver Tower, Char Yong Gardens, Gillman Heights and Farrer Court sites it acquired some years back. It plans to start launching them after the third quarter of 2009 at the earliest.

The units represent some 4.5 million sq ft of space. CapitaLand’s effective stake is close to two million sq ft while its partners in some of the projects hold the rest.

According to Ms Chia, the Silver Tower site – renamed Urban Resort Condominium – and the Char Yong Gardens site will hit the market first, towards the end of the year when the new malls in Orchard Road are up and running.

‘That period will enable us to really maximise the value for these two developments,’ she said.

The Urban Resort Condominium will have 64 units and the Char Yong Gardens plot will yield around 150. The freehold parcels, next to each other, will feature complementary resort-style designs, courtesy of Kerry Hill Architects.

In a June 10 report, Kim Eng analyst Wilson Liew estimated the projects will sell for an average of $2,000 psf.

The 99-year leasehold Gillman Heights (The Interlace) plot is next in line for release, and some 1,000 units should be ready for launch at the start of 2010. CapitaLand and its consortium partners took more than two years to close the $548 million deal last month and will begin redevelopment after November, when all residents have left.

The group has appointed OMA – known for the CCTV headquarters project in Beijing – to design the project. There will be ‘a lot of attention to space’, to tie in with the site’s proximity to the southern ridges, said Ms Chia.

Kim Eng’s Mr Liew has estimated a breakeven cost of $753 psf for the site, with an average selling price of $900 psf.

Among the last to come on-stream will be the Farrer Court site near Farrer Road, which CapitaLand bought with partners for more than $1.33 billion in 2007. The project, near the popular Nanyang Primary School, will comprise seven 36-storey blocks with around 1,500 units, offering residents a good view of the area, Ms Chia said.

‘If we were to launch it today, we would not be doing justice to the site,’ she said. The launch will happen ‘when the market is ready to accept that location with the kind of pricing that we want’.

According to Urban Redevelopment Authority caveats, units at the 12-year-old Gallop Gables nearby sold for up to $1,312 psf last month. Reports last year suggested the breakeven cost for the Farrer Court project could range from $1,350 – $1,450 psf. But Ms Chia said that this should have fallen as construction and other costs have eased about 20 per cent since.

‘We have a very strong financial position,’ she said. ‘It gives us quite a lot of flexibility to plan our launches.’

According to her, CapitaLand Residential Singapore typically has a market share of 8-10 per cent on a three-year moving average basis.

Ms Chia remains fairly upbeat on the property market here. The general consensus points to Asia as the economic growth leader, and Singapore is one of the few cosmopolitan cities in the region where asset values have corrected to ‘reasonable’ levels, she said.

.

URBAN SUITES at former Char Yong Gardens (D09) FreeHold New Launch Soon!!

Targeted Launch Date: 2nd/ 3rd Week of Novemeber 2009

Freehold New developments coming soon at former Char Yong Garden, near Paragon Shopping Mall. Located in Singapore's prime Orchard Road District, Char Yong Gardens sits on a 8,665.4-square metre (93,274 square feet) freehold site with a gross plot ratio of 2.8.

Char Yong Gardens is located in the heart of Orchard Road District, which is Singapore'smost chic and vibrant lifestyle and shopping area. With the remaking of OrchardRoad, the entire district will be further transformed into a choice residential andlifestyle destination for both expatriates and cosmopolitan Singaporeans.CapitaLand plans to build a luxurious 20-storey condominium with approximately 165 generously-sized apartments.

The site is in an excellent location as it is within walking distance of shopping mallsand a host of dining and entertainment facilities. It enjoys great transportconnectivity via the Somerset MRT station as well as the nearby CTE. The site isalso located near popular malls such as Paragon, Ngee Ann City, The Heeren andnew malls being built in the Somerset area.

Good schools nearby include theAnglo-Chinese Junior School, Chatsworth International School and the OverseasFamily School.

Sophia Residences D9 FreeHold New Launch

GOOD BUY!! 3Bdrm 1339Sqft Only 1518PSF!! Cheapest In D9 FH !!!

Penthouse Only 1099PSF!!!

Call Catherine +65 81330501

Property Information

| Development Name: | Sophia Residence |

| Property Type: | Condominium |

| Developer: | GuocoLand Group |

| Tenure: | Freehold |

| Expected Completion: | 2012 |

| # of Floors: | 14 |

| # of Units: | 272 |

Available Unit Types:

Property Facilities:- 1-Bedroom (610 - 610 sqft) SOLD OUT

- 2-Bedrooms (790 - 800 sqft) SOLD OUT

- 3-Bedrooms (1,030 - 1,460 sqft) RUNNING FAST!!

- 4-Bedrooms (1,840 - 2,060 sqft) SOLD OUT

- Penthouse (1,640 - 2,960 sqft) RUNNING FAST!!

|

|

|

Unique Selling Points

• Winner of the prestigious BCA Green Mark Platinum Award

• Only high-rise 14-storey Freehold condominium on elevated land within Mount Sophia

• Convenient foot access to Orchard Road

• Short stroll via 2 side entrance/exit to Dhoby Ghaut MRT transport hub

• Ideal for own occupation

• Good rental returns

• Living in the heart of Singapore’s Arts & Cultural District, combining arts & commerce, business and please all within one square mile

• Near the South Beach development with 2 towers (45- & 42-storeys high) and boast premium office space, 2 luxury hotels, exclusive city residences & high-end retail space

• Within 1km to St. Margaret’s Primary School

• Near to Singapore’s Educational, Arts & Cultural Hub – SMU, MDIS, Nanyang Academy of Fine Arts (NAFA), University of Chicago etc

• Close to lush landscaping such as Istana Park, Bras Basah Park, Fort Canning Park

• Convenient access to city and various areas via major expressway (CTE, PIE, ECP)

• Quiet and tranquil environment

BCA Green Mark Platinum Award

(Prestigious award with practical eco-friendly features)

1. Excellent natural air circulation & indoor air quality

• Orientation of apartment layouts

• Low volatile organic compound & special odour-removing photo-catalytic paint

2. Savings in electricity & water bills

• Innovative façade design to minimize heat gain

• Renewable energy from solar panels / photovoltaic modules

• Smart water management & harvesting system

3. Key design features

• Eco & bio filter stream / pond system that double up as natural lighting source for basement carpark

• 200m long landscaped roof garden – equivalent to the height of a 55-storey building

• Lush vertical green walls integrated with intimate landscaped courtyards & garden trails within the estate

Labels:

Condos,

D9,

Dhoby Ghaut MRT,

FreeHold,

SMU,

Sophia Residences,

SOTA,

Urban Suites

Subscribe to:

Posts (Atom)